9.(REUTERS/Jason Lee) Zhou Xiaochuan,governor of China's central bank,a high-level Chinese official on Sunday made the government's first admission that the country's economic slowdown was not going as planned.He told a meeting of regional leaders that his country's growth rate had tumbled "a bit too much."

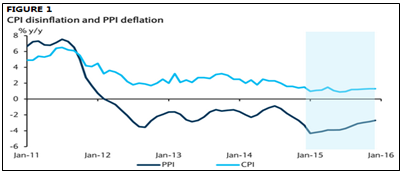

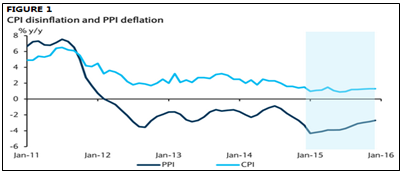

"China's inflation is also declining,so we need to be very careful to see if the disinflation trend will continue,and if deflation will happen or not,"said Zhou,His remarks were made at the Boao Forum for Asia,an annual conference on the island of Hainan in southern China.Zhou added that China could"have room to act"by taking"quantitative measures"and setting interest rates.

For many,the way he described China's health was no surprise.The country's economy has not been growing this slowly since the 1990s.Companies in debt are seeing sickly profit margins.Banks are carrying loads of debt,too,and the housing market is slowing.China's official 2015GDP growth target is 7%,but that seems shaky.

Acknowledging that significant intervention has to be on the table is a big deal for China.Everyone has known for years that this slowdown was coming because the government is purposely transitioning its economy from one based on foreign investment to one based on domestic consumption.It is a brutal process,but the government knows it is the only way the country will become the self-sustaining superpower it wants to be.

(Barlcays)Until now,while the Chinese government had acknowledged the slowdown was rough,it had assured the world that the situation was under control.Just a few weeks ago,Chinese officials were saying they would be monitoring deflation but still were not that keen on intervening with policy measures.

Now it seems they are warming to the idea.In January,China's headline consumer price inflation hit 0.8%,then it bounced back up to 1.4% in February.March probably isn't looking that great either from the People's Bank of China's point.

"Widening PPI deflation and soft CPI inflation,especially after adjusting for seasonal effects,point to persistent deflation risks,"Barclays wrote after February's number came out."In our view,the monetary policy needs to be more'proactive'in order to deal with the cyclical challenges in the near term."

58.Which of the following illustrates"growth rate had tumbled"in Paragraph 1?D

A.setting interest rates

B.economic transition

C.bounce of CPI

D.FIGURE 1

59.We can infer from the passage that one of the solutions to the slowdown could beC if needed.

A.monitoring deflation

B.expanding foreign investment

C.making new policy measures

D.reducing domestic consumption

60.Which of the following could be the best title for the passage?B

A.Zhou's admission is a big deal and a little bit irresponsible.

B.The Chinese government has admitted that things aren't going so well.

C.China should be more active in its struggle against inflation.

D.China's economy has been growing fast since the 1990s.